One by one, marketplaces are shutting down.

First Async Art, then Known Origin, then Makersplace. SuperRare is quieter, but seems to be shifting towards a model where Transient Labs takes the lead. On Solana, exchange.art got acquired by memecoin BONK, while Drip.Haus was bought by the decentralized exchange Jupiter.

Outside the art world, X2Y2 and SimpleHash have also shut down—X2Y2 pivoting towards AI, and SimpleHash being acquired by the wallet Phantom.

Zora made a radical pivot: now you can only mint ERC20 tokens with an image and a fixed supply of 1 billion coins. Traders are there, but are they really interested in the art? Or just chasing the airdrop?

Over at Opensea’s second version, there’s an ongoing accumulation of experience for a future airdrop. The homepage of the new version also shows live prices of many tokens.

More than ever, the line between fungible and non-fungible tokens is blurring. The future of NFTs seems to be heading in two directions:

More self-custody, with the downside that everyone has to manage everything alone.

A tighter integration between fungible and non-fungible tokens, at the risk of losing the concept of digital scarcity.

These two aren’t necessarily incompatible—but one requires flawless execution to make everything sellable, while the other depends on trading volume to collect fees.

Current State of the Market

So what’s happening in the market to trigger such a radical shift? Looking at USD volumes won’t tell us much—like every year-end, there’s a volume spike followed by a drop. From a profit & loss perspective, PFPs have been a disaster (especially after the sale of CryptoPunk #3100).

To get a better view, I’d like to introduce some KPIs you might not be used to seeing: retention rate and category intersections. If you’re planning to use NFTs in your project, wouldn’t it be better to know how people actually behave?

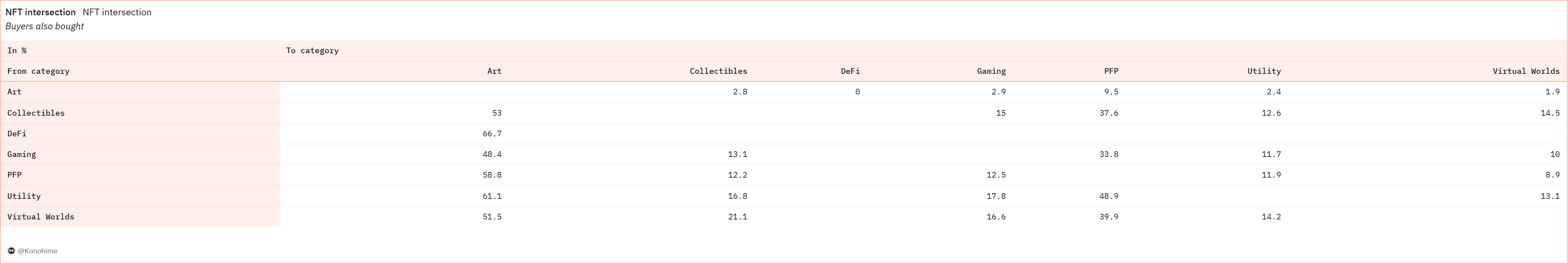

Let’s start with category intersections back in 2021. The majority of people who bought Collectibles, PFPs, Utility NFTs, or Virtual Worlds also bought art.

Avatar buyers naturally gravitated towards Utility NFTs (like linking their ENS name to their avatar), but also to Collectibles and Virtual Land, hoping to use their avatar in a virtual world.

In 2024, things have changed. Art collectors have diversified, especially into PFPs. On the flip side, fewer people bought art, and buyers in general became less diversified. Only virtual land buyers have continued purchasing PFPs at the same rate.

Something that barely existed in 2021 has appeared in 2024: DeFi NFT buyers (like Uniswap LP tokens or other finance-related assets) are now buying a lot more NFTs than they used to.

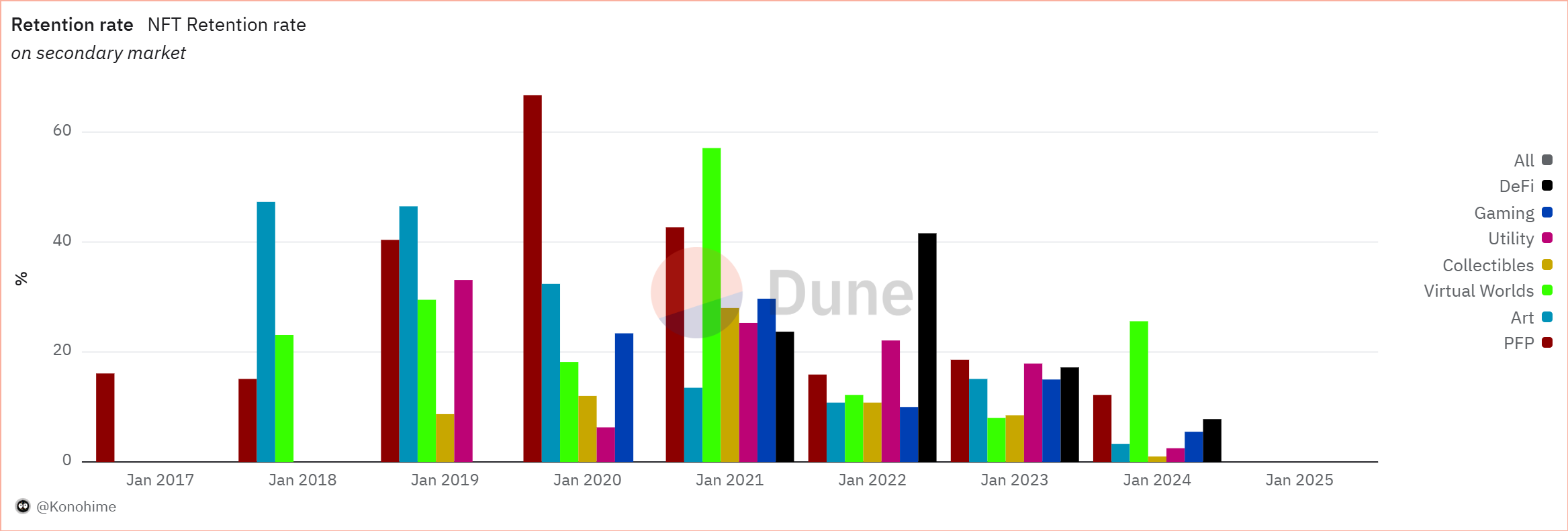

Okay, NFT buyers have changed their habits—but maybe they’re still buying the same stuff? Not really. Looking at retention rates, buyers who purchased NFTs in one category are less and less likely to come back in later years. This drop is partly due to fewer buyers overall… but mostly because people are losing money.

Except for December, when Pudgy Penguins and Azuki airdrop announcements made holders some profit, collectors across all categories have generally been losing money since the beginning of the year.

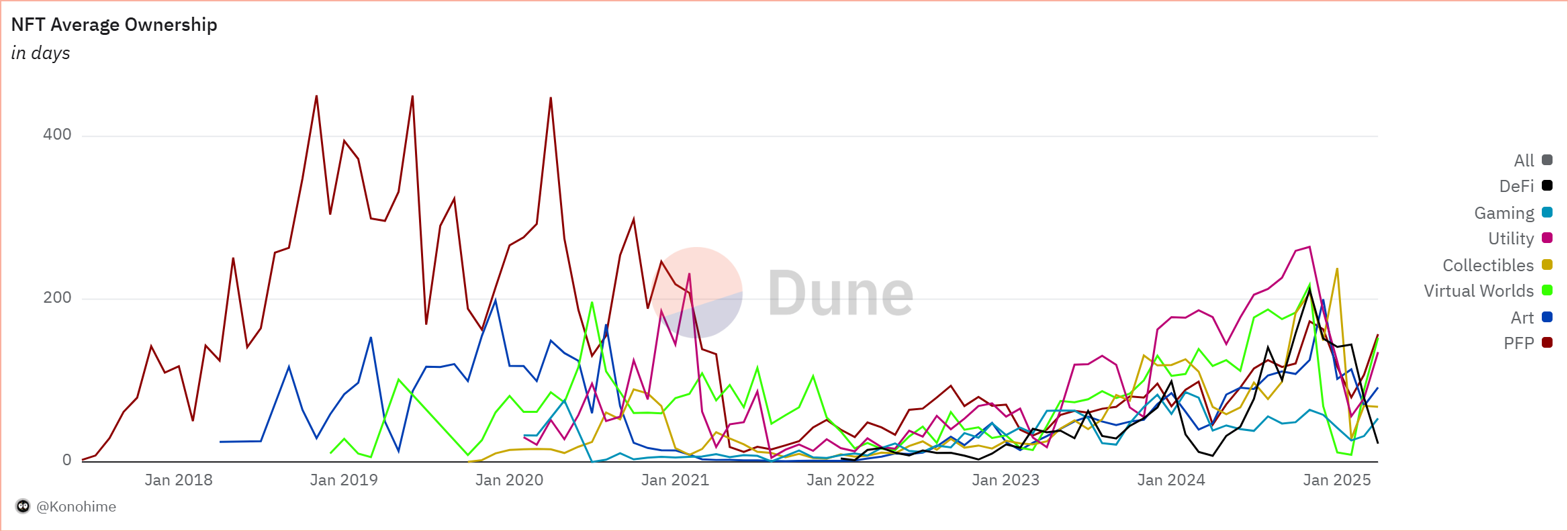

To finish this market analysis, here’s the chart of the average holding duration (in days) across categories. Since 2022, the tendency to “hold” has gone up—except for art, which seems to have decoupled from the other categories in early 2024.

December 2024 saw a mass sell-off, but things quickly returned to previous levels. Do these shifts in ownership hint at something more positive coming?

NFTs as We Knew Them Are Gone

The NFTs of yesterday promised an artistic revolution, a digital paradigm shift, new rules, and a new code. But a few years later, the legacy players are gone, the NFT vision has changed, and now making money requires hard work. Most use cases have already been explored.

The Wild West era is over—no more “it’s just like the early internet.” What we have now is a market dominated by institutions or companies trying to innovate, but abandoned by a public split in two: short-term speculators on one side, and hardcore believers still convinced blockchain has a future for their personal projects.

So, what’s next? Will we move towards full self-custody and a return to cypherpunk roots? Or will we keep diluting liquidity by launching more and more coins, hoping to attract more users?

Photo : Stephanie Harlacher

Self Promotion Time

If you want to discuss more about NFTs, Web3, or any other futuristic concepts, feel free to reach out!

If you want to see my works :

Leave a comment